The eCommerce Picture for the First Half of 2020

Since the advent of coronavirus, lockdown and the corresponding surge in ecommerce, we’ve been publishing a week-by-week analysis of each month’s GMV performance. You can find June’s post here. In this post, with us entering the second half of the year, we thought it would be illuminating to review what’s happened in H1.

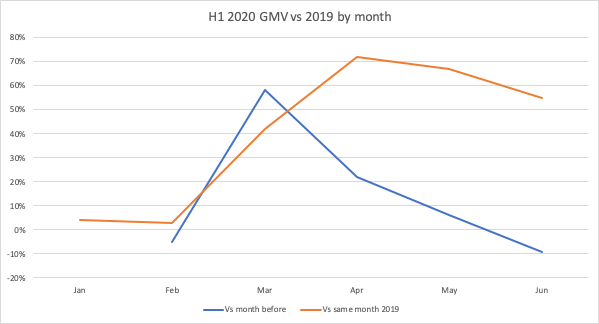

Here’s what we’ve been seeing across the Volo Origin platform since the beginning of the year. As with our monthly research, for a more accurate insight we’ve isolated the growth across a ‘same set’ group of Volo customers. That way we can attribute the performance to the growth of online commerce rather than our own growth in acquisition of new customers.

- For January 2020, GMV was up 4% on January 2019

- For February 2020, GMV was down 5% on January 2020 (but it’s a 10% shorter month), and up 3% on February 2019

- For March 2020, GMV was up 58% on February 2020, and up 42% on March 2019

- For April 2020, GMV was up 22% on March 2020, and up 72% on April 2019

- For May 2020, GMV was up 6% on April 2020, and up 67% on May 2019

- For June 2020, GMV was down 9% on May 2020, and up 55% on June 2020

This ecommerce picture for H1 2020 faithfully tells the story of what has happened to the wider world so far this year. January and February started innocuously enough, perhaps like the beginning of any other year in recent memory, with modest growth on the year before. Nothing out of the ordinary here.

Then in March, the virus took hold in the western world and countries implemented their lockdown procedures from the middle of the month. Forced online, virtually overnight, as the safest channel for essential items, existing users and a whole swathe of new customers bought heavily. March closed over one-and-a-half times higher than March 2019.

April saw this growth supplemented by consumers, faced with the prospect of a long wait before they could do anything outside of the house and garden. People invested in leisure items and office equipment for inside, and leisure items for outside, with the demand further fuelled by a glorious Spring season. April, although a shorter month, still increased by almost a quarter over an already massive March.

In May there was still another uplift on April’s figures, but at a slower rate and there were signs that the peak of coronavirus and ecommerce had passed in many countries as they started to ease restrictions. Despite this, May ecommerce was a full two-thirds higher than 2019.

Finally, after 3 months of successive growth, June’s ecommerce declined very slightly, but with levels for the month still more than half what they were 12 months before. As we move into July and the second half of the year, the question in most people’s mind is this: what shape will this curve be? Is it more bell-shaped, with us returning to pre-coronavirus ecommerce levels, or will the decline stabilise at higher than pre-coronavirus levels and then grow again from there?

Global lockdown compressed 5 years’ worth of ecommerce growth into 5 weeks and so, barring any dramatic spikes and re-introduction of restrictions, it seems reasonable to assume we will settle somewhere within the range of these 2 scenarios.

Sellers will be hoping that it’s somewhere hear the upper end of the range, and should be working hard to convert their rafts of new customers into regularly returning customers.

How do you see H2 2020 shaping up? What does the future hold for the Christmas lead-in? To discuss your own requirements to capitalise on your ecommerce growth plans, please get in touch with us here.