Ecommerce Marketplace Activity November 2020

In this post we analyse November’s marketplace and web store GMV across the Volo Origin and Vision platforms and use it to guide us on the overall ecommerce picture. Volo customers sell across all the major retail categories on web store platforms and across around 80% of marketplace GMV, so we can consider them a pretty good proxy for UK ecommerce activity.

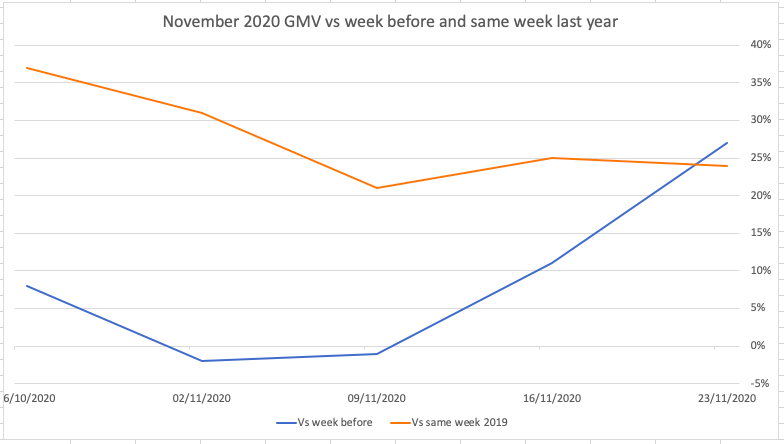

Here are the figures week-by-week for November 2020, which includes Black Friday, the 27th. In our monthly analysis we take a 3-figure ‘same set’ group of established customers to measure their year-on-year growth as a reflection of their organic growth rather than our own growth through new customer acquisition. We’ve included the week of 26th October from the October post as it includes Sunday the 1st November, while Monday 30th November will figure in the December 2020 figures.

- Week of 26th October, GMV was up 8% on the week before, and up 37% on the same week in 2019

- Week of 2nd November, GMV was down 2% on the week before, and up 31% on the same week in 2019

- Week of 9th November, GMV was down 1% on the week before, and up 21% on the same week in 2019

- Week of 16th November, GMV was up 11% on the week before, and up 25% on the same week in 2019

- Week of 23rd November, GMV was up 27% on the week before, and up 24% on the same week in 2019

Once again, these figures mirror exactly the state of the country and economy during the month, as the UK went into its second lockdown, which was not as severe as the first. In October we saw the 2020 uplift on 2019 maintained at around 20%, following the Covid peak during Q2. With the second lockdown, November ecommerce again jumped to be around 25% up on the year before. Not quite the onerous restrictions of the first lockdown, therefore not quite the peak we saw in April and May, but still very strong for those retailers active on online channels.

Black Friday 2020, the 27th, saw an uplift of 27% on Black Friday 2019, the 29th. Again, this is exactly in line with expectations. We can account for this by considering the November lockdown and also the twin facts that the Black Friday deals are not always the genuine deals they used to be and the Black Friday/Cyber Monday spike has become somewhat elongated over the end of November and beginning of December.

How is December looking for marketplaces and web store ecommerce? With Cyber Monday, the 1st, already under our collective belt, and the UK emerging from lockdown into either level 2 or level 3, we still expect a robust December in excess of 20% over the corresponding month in 2019. While there is light at the end of the vaccination tunnel – and indeed the vaccination process is underway – we anticipate a ‘slow and steady’ return to relative normality for physical retail. Heading into 2021, and a probable third spike in coronavirus after the Christmas and New Year get togethers, ecommerce activity for the traditionally quieter months of January and February is highly likely to buck the annual trend.

To discuss your plans and requirements for Q1 2021, please get in touch with us here.