Ecommerce Marketplace Activity October 2020

In this post we show last month’s analysis of GMV across the Volo Origin and Vision platforms and use it a proxy picture of general web store and online marketplace activity. Volo customers sell across all the major retail categories on web store platforms and across around 80% of marketplace GMV, so we can consider them a pretty good guide of what’s happening in UK ecommerce as a whole.

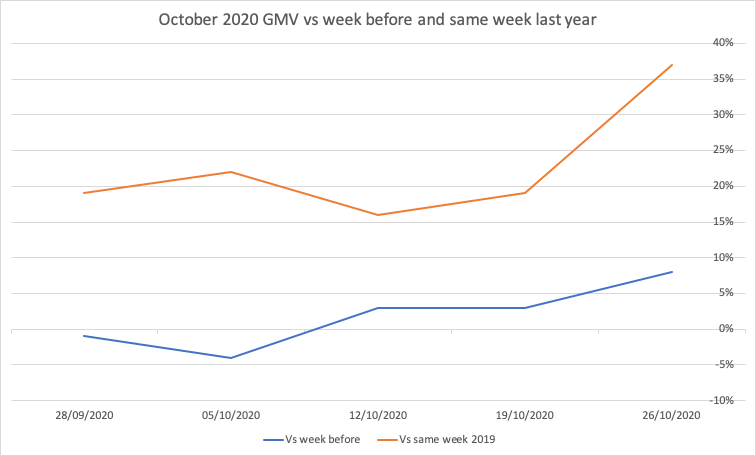

Here are the figures week-by-week for October 2020, a month which saw the Q4 peak start earlier than ever with the delayed Amazon extravanganza that is Prime Day – or more accurately Prime Days – as well as a more muted Halloween due to the ongoing societal restrictions. In our monthly analysis we take a 3-figure ‘same set’ group of established customers to measure their year-on-year growth as a reflection of their organic growth rather than our own growth through new customer acquisition. We’ve included the week of 28th September from the September post as it includes some of October, while the week of 26th October includes Sunday the 1st November.

- Week of 28th September, GMV was down 1% on the week before, and up 19% on the same week in 2019

- Week of 5th October, GMV was down 4% on the week before, and up 22% on the same week in 2019

- Week of 12th October, GMV was up 3% on the week before, and up 16% on the same week in 2019

- Week of 19th October, GMV was up 3% on the week before, and up 19% on the same week in 2019

- Week of 26th October, GMV was up 8% on the week before, and up 37% on the same week in 2019

The month of October continues the trend established in September, where GMV maintained around a 20% uplift on 2019 figures. During the month there was a gradual uplift in week-on-week revenues, signifying the start of the peak shopping period, ending with a very strong final week which was more than a third stronger than the same week last year.

As we mentioned, the week of October 12th featured the two Amazon Prime Days of the 13th and 14th. Comparing Prime Day 2020 with its 2019 predecessor would be comparing apples and oranges, since the 2019 version was held in July. We can draw some conclusions about the influence of Amazon to ecommerce activity, however.

When we compare the two days with the same two days the week before, we see that Amazon GMV was up 33%, whereas non-Amazon GMV was down 6%. Likewise, comparing the same two days in 2019, Amazon GMV was 53% higher, whereas non-Amazon GMV was up 14%. We can safely say, then, that Prime Day was successful for Amazon and Amazon sellers.

What is November and December going to look like for ecommerce? As we publish this the UK is about to enter a second lockdown phase that will last at least until the beginning of December. Two of most important days of the retail year, Black Friday and Cyber Monday, and arguably one of the busiest retail months, will take place almost completely online. It doesn’t take a huge leap in argument to suggest that marketplace and web store activity will spike at similar levels to Q2 of this year, or at least show a familiar trajectory.

To discuss where you’re placing your bets in 2021, and how you can be best set up realise them, please get in touch with us here.